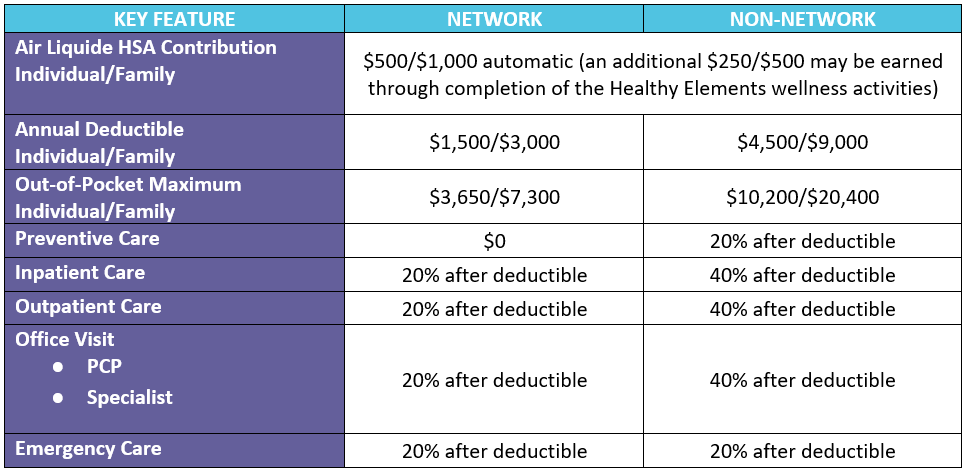

In this High-Deductible Health Plan (HDHP) you must meet an annual deductible before the plan begins paying a portion of the cost. When you enroll in the Choice Savings Plan you can save tax-free money in a Health Savings Account (HSA) to cover qualified health expenses.

- In this plan you’ll pay higher monthly contributions for a lower deductible.

- If enrolled in this plan you’ll receive an automatic company seed to your HSA — $500 for employee only coverage or $1,000 for family coverage. (Employees who start mid-year after July 1 will be prorated to $250/$500.) You can also make pre-tax personal contributions to your account. Additionally, Air Liquide will contribute an additional $250 for employee-only coverage or $500 for family coverage to your HSA once you complete a Biometric Screening and the Health Assessment through Healthy Elements. The combination of your personal contributions and Air Liquide’s contribution must not exceed the annual limits set by the IRS of $3,650 for individual coverage and $7,300 for family coverage in 2022.

- In-network preventive care is covered at 100%

Progyny Smarter Fertility Benefits

Air Liquide offers comprehensive fertility benefits through Progyny to support every path to parenthood. Comprehensive Coverage includes IUI, IVF, egg freezing, adoption counseling and more!

Through this benefit you have convenient access to the largest national network of fertility experts, unlimited guidance and support from dedicated Patient Care Advocate throughout your fertility journey. To learn more and get started, call: 833-851-2235.